You are here

Geology and The Bottom-Line

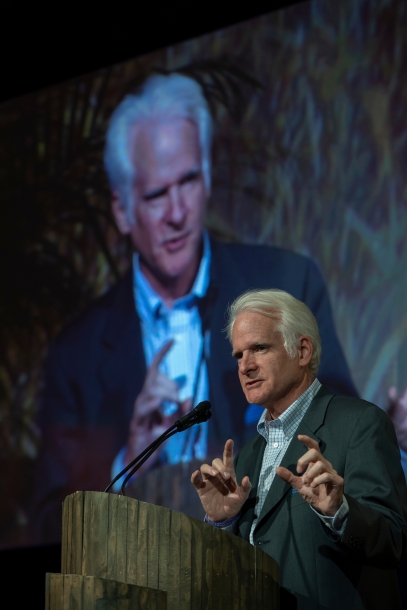

Hannah Jones, VP of Sustainable Business and Innovation at Nike, had the most memorable lines among dozens of speakers at two recent conferences, the “Ceres Conference 2011: Igniting Innovation, Scaling Sustainability” and The Conference Board’s “Corporate Citizenship and Sustainability” gathering in Washington, DC. Hundreds of senior executives from America’s leading corporations exploring urgent questions of climate stability, water resources, sustainable agriculture, and innovation and entrepreneurship. But Jones stole the show with two powerful remarks. Knitting together transparency, a key metric for responsible corporate reporting, with core business performance, she quipped that “if you’re going to be naked you better be buff!”

At a more granular level, we learned why SAP, in a small but significant shift, now releases financial results with its sustainability report, forcing a common language across the NGO and financial communities. If you want to see SAP’s carbon footprint you cannot escape their profit and loss statement; and if you are looking for their operating margin you also come face to face with “total energy consumed.”

We also reengaged what I see as an increasingly tired question -- is there “a business case for sustainability?” Do companies ‘do sustainability’ to make money, to reduce costs, or to enhance license to operate, brand equity, and to retain new and younger employees who want to feel good about their work every day? We heard powerful examples of business growth, market opportunities created, and profits generated from embedding sustainability in corporate DNA and also using it as a lens to drive innovation.

But – and it is a big but – it seems to me that the way we have framed this debate diverts us from the core sustainability challenge. And that is how we think about time. There is a disconnect between the incentivized behaviors of short-term profit-maximizing corporations and the increasingly bold proclamations by corporate leaders that their organizations will increasingly act with the interests of intergenerational equity at the forefront of strategy, planning and business operations.

Whether the fossil fuels we use to generate electricity, water to make myriad food products, or trees for desks and paper; all of the natural resources (including atmospheric gases) that we use to make products (or hold industrial “wastes,” like carbon) exist across a geologic time-scale measured in hundreds of millions of years. Three-year ROIs and quarterly earnings reports are but microscopic specks of dust across, for example, the 350,000,000 million years during which coal was formed from giant plants that died long before the dinosaurs.

When we ask (and ask and ask!) that sustainability justify itself on the altar of modern-day market capitalism, is this not a bit like arguing with a lump of coal over its own formation? We, rather than the coal, are the newcomers; who says it needs to explain itself to us? Coal is surely not going to adjust to our short-term needs. The core question is thus not about the business case for sustainability but rather the lack of a sustainability case for short-term profit maximizing behavior.

Done right, over a time-scale that accommodates both geology and the bottom-line, human ingenuity and nature’s incredible diversity and robustness can likely find a harmonious synergy. But this will take real leadership.

Who among the leaders of the Fortune 500 wants to tackle this issue of time and link his or her compensation equally to sustainability performance and profits by insisting that compensation be reviewed on a three-year basis across an integrated bottom line? Who at the SEC wants to lead the charge to bring corporate oversight out of the 19th century and into the 21st century by moving beyond limited reporting of climate risk to helping figure out how to bring trillions of dollars of environmental externalities onto the books of our nation’s corporations?

Hannah Jones also noted that at Nike, “we are measured against our potential.” Who among our corporate leaders today has the courage to just ….?

- jonathan.halperin's blog

- Log in or register to post comments