You are here

Where’s The Pork?

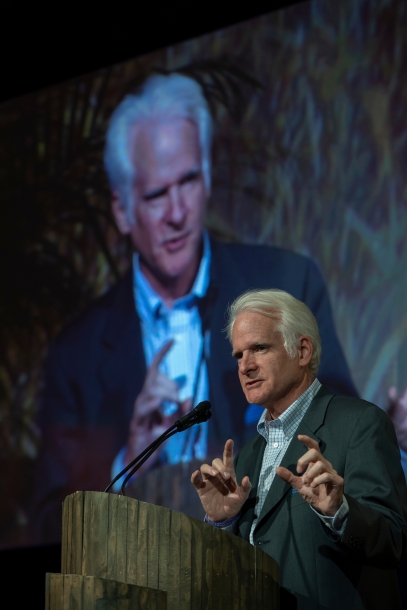

Chipotle lost about one-third of its pork supply early in 2015 and signs popped-up in roughly 500 restaurants announcing that “carnitas” was unavailable. From the corporate HQ, PR Director Chris Arnold positioned his company’s handling of this supply shortfall as evidence that it stands behind its brand that promises “food with integrity.” Indeed, Chipotle did the right thing by deciding to curtail purchases from a supplier that violated its animal welfare pledges and in refusing to substitute substandard product to make up for that shortfall. (See Jonathan J. Halperin's interview in Forbes, Chipotle's Pulled Pork and What It Means For The Company And The Industry, January 16, 2015.)

But, without questioning the sincerity of either Chris Arnold or CEO and founder Steve Ells, I think there is more to this story than they are sharing. The real risk for Chipotle here is not so much a short-term sales dip or supply-chain headache, but rather that it is drawing down its supply of customer good-will and brand integrity. And Chipotle deserves credit for changing (some might say, creating) the fast casual food sector by selling not only great taste but also an ethos of responsibility from farm to table.

In a wired world that accentuates the truism that information abhors a vacuum, the fact that Chipotle won’t really say what pledges were violated leads to speculation. Was it farrowing crates or slatted floors as some analysts have surmised? Something else entirely? Only Chipotle knows; and they are not telling.

Given its deserved reputation as an industry-leader, Chipotle likely won't take as much heat around this as it otherwise would, but for one-third of its pork supply to dry-up in an instant raises questions about the scale of the problem. If it is, in fact, traced back to hard infrastructure and facilities construction at a major supplier, rather than a temporary failure to abide some specific procedure, this raises further questions. Chipotle asserts that the problem was detected in a “routine audit.” How often are suppliers subject to audits? Who conducts them? One has to wonder why the problem was not identified before it put 30% of the supply at risk.

Chipotle’s rapid expansion and success hold important learnings for other companies. There is a huge amount of information fuzziness around the whole notion of standards: who sets them, what they require, and how much they matter. Customers are right to be skeptical of unsubstantiated claims. Most well-defined are government statutory and regulatory requirements companies must comply with for their business operations. Less tightly defined are specific codes set by individual companies that their suppliers must abide. Even less stringent are standards that companies require suppliers to meet; these are often more vague, especially as to how suppliers demonstrate compliance. More vague are aspirational, often undefined, principles such as Chipotle’s concept of “responsibly-raised” animals. At the lowest end of the spectrum are unsupported claims and pledges of evolutionary progress toward “better” or “equitable” or “humane” or “natural” treatment of animals.

When Chipotle itself is not fully forthcoming, there is a hollow ring to its request that we respect its choice not to “waste resources reporting, but rather spend them on doing the right thing.” This reluctance to share information has irritated institutional investors and a shareholder resolution was submitted last year calling on Chipotle to publish a sustainability report. The resolution was supported by about 30% of its shareholders.

Sustainability reporting clearly has limits in terms of its usefulness to drive transparency and change behavior. But there is also a minimal threshold for reporting. For a company that has aggressively positioned itself as different and better, the refusal to share important information that is clearly material to its business operations tarnishes its reputation as a change-leader. There is a temptation to give Chipotle a pass in this situation and shift the focus to the laggards in the food sector (such as Koch Foods, Pilgrim’s Pride and Walmart). However, there is value for the food sector as a whole to focus on important issues when people are paying attention. It may not be fair, but people do pay attention when leaders stumble; it’s the price of leadership. Witness Brian Williams’ disastrous stumble.

Based on last year's shareholder resolution calling for greater transparency, it seems likely that this year even more than one-third of Chipotle’s shareholders will want to know what happened to one-third of its pork. While the supply problem will surely be managed, the disclosure issue may be more important.

- jonathan.halperin's blog

- Log in or register to post comments