You are here

Markers of Corporate Purpose, Part II

Purpose seems to be catching fire. Empowered by yet another horrendous school massacre, students from Parkland have changed the American conversation in a momentous way. The impact ranges far beyond the overdue debate on controlling assault weapons in the United States.

Companies once seemingly isolated from the issue of guns are being swept into an already heated discussion of corporate purpose.

- Ed Bastian, CEO of Delta, grabbed the headlines recently with his assertion that “…our values are not for sale,” after the Georgia State Legislature showed its values by yanking a tax-break for Atlanta-based Delta after the airline succumbed to pressure and cancelled a group travel discount it had offered NRA members.

- Larry Fink, Blackrock CEO, earlier wrote a letter that earned him kudos for championing a view that would not long age have been generously dismissed as quirky: “To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.”

- And not to be left out, CEO André Calantzopoulos, head of Phillip Morris, the company that once epitomized corporate malfeasance, announced a plan for the company to go “smoke free: …we have a duty to our business that we ensure we have a viable business going forward, so we’re investing in alternatives so we provide a future for them, as well.”

In the first blog of this series I shared some views on how companies are finding competitive advantage in purpose. This is not a passing fad. It has potency but not because big organizations are getting on a bandwagon. People, not organizations, are driving this.

In purpose we find meaning; in meaning we find ourselves.

Let’s look carefully at the three statements above. The last is perhaps the oddest. The comparison of Philip Morris to Patagonia in the attached article from Sustainable Brands is startling. I imagine finding these two companies in the same bucket has the founder of Patagonia, Yvon Chouinard, either laughing or horrified – or both. Patagonia has walked the talk of being a purpose driven company since Chouinard begin making chocks and surfboards in 1973. Despite growth and expansion into mainstream apparel markets, Patagonia has continued to align its products and manufacturing, marketing communications, activism, and policy positions around an exacting and exemplary mission:

Build the best product,

cause no unnecessary harm,

use business to inspire and implement solutions to the environmental crisis.

Patagonia has also been a leader in the BCorp movement, a shift in structure that enables corporations to put purpose and profit on a level playing field. (For further discussion of benefit corporations see the first installment in this series.)

On the other hand, for well-on a century PMI has been a global leader in producing “cancer sticks,” i.e. cigarettes. Its mission couldn’t be more different:

to own and develop financially disciplined businesses

that are leaders in responsibly providing adult tobacco and wine consumers

with superior branded products.

Aside from the fact that it seems to have been written by a linguistic contortionist, it speaks not at all to social purpose, gives only a passing nod to being responsible, and makes clear the core purpose remains exactly what Larry Fink from BlackRock decries in his letter to corporate CEOs

Further exploration of Phillip Morris purpose leads only deeper into the circular double-speak. While boasting that it is “Designing a Smoke-Free Future,” the company “operate[s] 46 production facilities in 32 different countries and produce[s] over 800 billion cigarettes each year.” Phillip Morris is Designing a Smoke-Free Future” the same way Exxon-Mobil is building an energy future devoid of fossil fuels – as slowly as possible, only when under extreme pressure to do so, and in order to maximize near-term ROI for shareholders regardless of the long-term consequences.

Before assessing the BlackRock and Delta letters more closely, let’s map what a company needs to do to not just talk about but actually demonstrate purpose – and it is, after all, in the demonstration that leaders accrue enduring benefits to brand, team, stakeholders and shareholders. Building on terrific work done by Generation IM with HBS and KKS, here our ten Markers of Corporate Purpose™ that we use to measure whether a company has or is developing a purpose beyond profit.

- People: staffing structure, benefits, wages, inclusion, training

- Resources: finance and human capital

- Culture: diversity, access, transparency

- Authenticity & Trust: Stakeholder engagement, regulatory and legal

- Trade-offs: patterns of decision-making

- Governance: structure, board, collaborations

- Advocacy: policy positions, campaign contributions

- Communications: lobbying, advertising, marketing, reports

- Alignment: products, purpose, operations, leadership

- Sustainability: targets, integration, reporting

Like more commonly referenced genetic markers, these Markers of Corporate Purpose™ (MCP) are not promises of what will happen but rather indicators of propensity. Taken together, however, they offer a benchmarking tool for assessing purpose.

More on our Markers of Corporate Purpose™ in the forthcoming, third blog of this series.

So, how does Delta stack-up on these markers for purpose? While Ed Bastian has been widely praised for his statement that “…our values are not for sale”, has that praise been earned or simply bestowed on him because of the understandable heat in the post-Parkland moment? Reading all of his short letter gives me pause, especially around MCP #4 and #7. While “Delta’s intent was to remain neutral, some elected officials in Georgia tied our decision to a pending jet fuel tax exemption, threatening to eliminate it unless we reversed course. Our decision was not made for economic gain and our values are not for sale. We are in the process of a review to end group discounts for any group of a politically divisive nature.”

It seems Delta was not really leaning forward into a courageous moral stand at all. But rather it was cornered into having to defend its decision vis-à-vis the NRA due to the actions of the radical right wing in the Georgia, Republican-controlled legislature. And Bastian back-pedals further by placing the NRA on equal footing with other groups of a “politically divisive nature.” This is corporate hypocrisy at its worst in that the entire ‘moment’ is about the sui generis nature of the NRA. Its fanatical financial and political advocacy of a civilians right to possess weapons designed for use by the military is categorically unlike any other. He then goes on to further pander to the NRA, kowtowing before the 2nd Amendment:

And we are supporters of the 2nd Amendment,

just as we embrace the entire Constitution of the United States.

As indicated in the link to the NRA’s own website, the 2nd Amendment, of course, says nothing about assault weapons and conveys no absolute right to own guns, clearly predicating that right on the need to “form a well-regulated militia.”

While it has garnered some short-term publicity benefits from a nice turn of phrase, Delta has also set itself up to fall well below the ambitious bar it has now set for itself in terms of living its values. Delta’s Rule of The Road articulate a solid set of values; the potential for leadership and purpose is there – as yet untapped.

By contrast, Larry Fink’s letter is a powerful statement: precise, blunt, and sweeping in its call for a fundamental rethink of the very core of what business is about in the 21st century. As a letter I give it high marks indeed:

"…a company’s ability to manage environmental, social, and governance matters demonstrates the leadership and good governance that is so essential to sustainable growth, which is why we are increasingly integrating these issues into our investment process.”

How quickly and openly that integrating happens is the question before Blackrock, the world’s largest asset manager, with $6.288 trillion AUM. Is internal guidance being re-written so buy-side analysts factor purpose into their day-to-day decisions? Is compensation being reworked to reward the values lauded in the letter?

How this unfolds will tell the tale of whether Blackrock is only advising others or also going to walk its own talk. As Yvon Chouinard might have it, is Larry Fink just paddling or actually surfing?

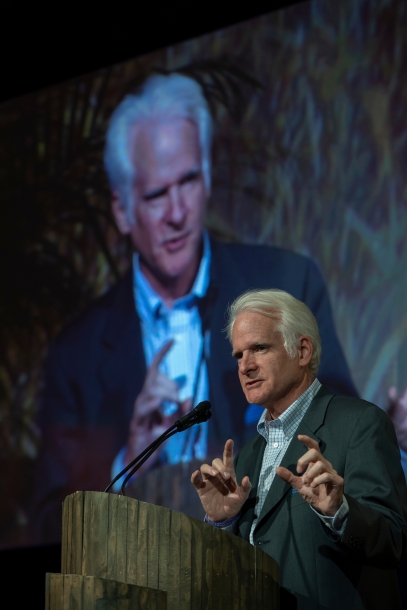

- jonathan.halperin's blog

- Log in or register to post comments