You are here

Markets, Governments and People

The notion that “what’s good for General Motors is good for the country” is actually a misquote of more complex 1953 testimony from Charles Erwin Wilson; “ …for years I thought what was good for the country was good for General Motors and vice versa…" At the time, Wilson was president of General Motors and President Eisenhower’s nominee for Secretary of Defense. Fifty-nine years later, 25% of General Motors’ stock is held by the US Government as a result of the financial crisis. But even absent crises, the neat dividing lines between governments and free markets is more dotted than it is bold. And it is likely to become even more squiggly in coming years. That shift, though needed, is fraught with risk and there are very diverse ways of re-blending responsibilities, markets and government.

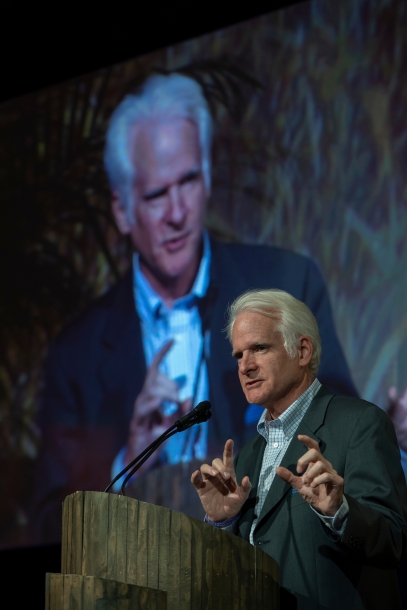

At the just concluded Global Philanthropy Forum in Washington, DC, there was much talk of the need to harness the power of markets to improve the world (see the full agenda and video of the proceedings).

| A terrific panel on impact investing (see "A Different Kind of ROI: The Role for Private Capital" to the right) championed this as a mechanism for blending and integrating charitable missions and investment strategies. The question being posed, rightly, is why focus so much on grants (generally 5% of foundation assets in the US) but not on the assets themselves as a means of driving change? |

|

The lure of the market, with all its attendant risks, is strong. And as articulated by Jed Emerson, Executive Vice President of ImpactAssets, to have impact foundations need to stop “acting like trout,” mostly hovering motionless in swirling water and only occasionally jumping to catch a bug as one passes overhead. Impact investing is needed, is a good idea, and is sure to expand in coming years.

From another vantage point, markets can undermine governments and cripple their ability to serve citizens. Privatization of government assets in the former Soviet Union was largely a massive transfer of wealth from the public trust into private hands. As a businessman in The Soviet Union throughout the 1980s and 1990’s it is clear to me that (despite some very serious efforts at fairness) the give-away of state assets was wholly corrupt, took place in a modern economy and resource rich country on a scale never before imagined, and will continue for generations to undermine public trust in state institutions while enriching a small elite. So while communism was vanquished, the structure of political and economic power in Russia today is perhaps more akin to what it was in Tsarist times than to that of a European or North American modern state.

Beyond the Russian experience, devolving public goods such as water into the hands of private firms, with the positive intention of attaching prices to increasingly scarce resources as a means of protecting them, have also run into major problems in countries around the world.

Markets may well be the most finely tuned mechanism we have for allocating resources efficiently around short-term costs and prices. But absent a robust framework of social and cultural values and priorities to channel market operations these efficient markets will lead to vast inequity and depletion of critical resources. That markets alone will protect and allocate scare resources such as water in a manner that is equitable and socially acceptable is a pernicious fantasy. When we dislike the role of government we refer to it disparagingly as the regulatory morass, command and control, and bureaucracy. When we favor it, we champion the level playing field.

But as we reorganize the social contract – changing the dynamic relationships between governments, markets and societies – the need for sound policy and effective government intervention is central to effective strategies for change. We live in a time where it is fashionable to trash government (bureaucrats, all), mock politicians (idiots, all), and demand that leaders be entertainers.

Through their terrific work with social entrepreneurs, organizations like Ashoka, The Skoll Foundation, Acumen and many others are empowering individuals to harness markets to meet pressing social needs. The winners of the Vodafone Wireless Innovation awards presented at the Global Philanthropy Forum were inspiring to all of us. Who would imagine mobile phones as a key imaging tool in diagnosing cancer? But to empower entrepreneurs and harness market forces is not to delegitimize government from its still central role in ensuring opportunity, freedom, and dignity for everyone -- regardless of the extent to which anyone can or cannot participate in the marketplace.

- jonathan.halperin's blog

- Log in or register to post comments